May 22, 2023This will serve as your proof of income until you get your first couple of pay stubs. Proof of government-funded income. Some tenants may receive income from rental assistance programs or government subsidies. Landlords can verify this income by contacting the program administrator or agency responsible for providing the assistance.

Printable Construction Profit And Loss Statement Template Excel Sample | Profit and loss statement, Statement template, Excel templates

Mar 3, 2023However, the requirements tend to be pretty similar. You’ll usually need a reliable source of income, monthly gross income of at least three times the rent, renter’s insurance, and at least

Source Image: innovatureinc.com

Download Image

May 22, 2023The formula for deriving this minimum income number varies by location and landlord preference. In most of the U.S., your monthly income (or the combined monthly income of everyone living in the rental) will need to equal at least three times the rent. So a $2,500 apartment would require you to earn $7,500 monthly, or $90,000 annually.

Source Image: cruseburke.co.uk

Download Image

A free rental property profit and loss statement template Aug 3, 2022The best way to do that is to require proof of income when a renter applies to rent your unit. Although some ways are more commonly used than others, here are 15 ways renters can show landlords or property managers proof of income. 1. Pay Stubs. Pay stubs are one of the most used ways to show proof of income. Renters with part-time or full-time

Source Image: mashvisor.com

Download Image

Do You Put Gross Or Net Income On Rental Application

Aug 3, 2022The best way to do that is to require proof of income when a renter applies to rent your unit. Although some ways are more commonly used than others, here are 15 ways renters can show landlords or property managers proof of income. 1. Pay Stubs. Pay stubs are one of the most used ways to show proof of income. Renters with part-time or full-time Jan 23, 2024Proof of income is a document or set of documents that verify an individual’s stated wages or earnings. This documentation is used by landlords to determine a tenant’s ability to pay rent. By evaluating a tenant’s monthly income, job status, past payment history, and debt status, landlords can determine if the applicant is a safe choice

Net Operating Income Formula: How to Calculate | Mashvisor

While application questions vary by landlord, expect questions about your identity, income, employment and past rental history. The application may also ask you to list personal references and to provide the name and phone number of an emergency contact. If you are confused about an application question, ask the landlord for clarification. Net Operating Income (NOI) | Formula + Calculator

Source Image: wallstreetprep.com

Download Image

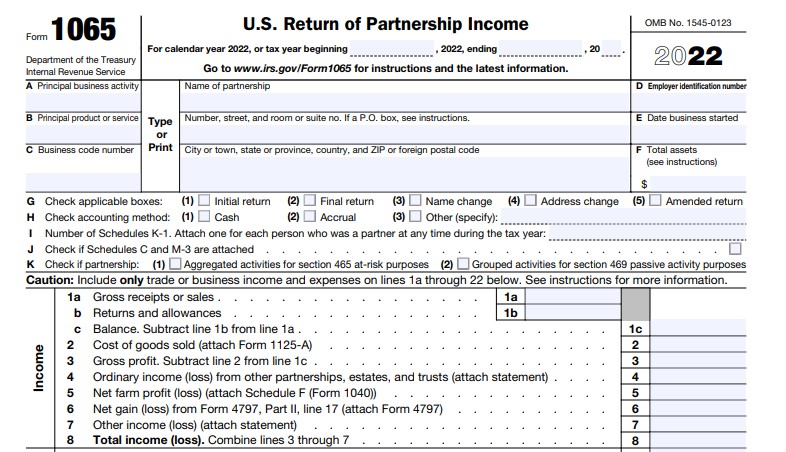

Form 1065 Step-by-Step Instructions (+Free Checklist) for 2024 While application questions vary by landlord, expect questions about your identity, income, employment and past rental history. The application may also ask you to list personal references and to provide the name and phone number of an emergency contact. If you are confused about an application question, ask the landlord for clarification.

Source Image: fitsmallbusiness.com

Download Image

Printable Construction Profit And Loss Statement Template Excel Sample | Profit and loss statement, Statement template, Excel templates May 22, 2023This will serve as your proof of income until you get your first couple of pay stubs. Proof of government-funded income. Some tenants may receive income from rental assistance programs or government subsidies. Landlords can verify this income by contacting the program administrator or agency responsible for providing the assistance.

Source Image: pinterest.com

Download Image

A free rental property profit and loss statement template May 22, 2023The formula for deriving this minimum income number varies by location and landlord preference. In most of the U.S., your monthly income (or the combined monthly income of everyone living in the rental) will need to equal at least three times the rent. So a $2,500 apartment would require you to earn $7,500 monthly, or $90,000 annually.

Source Image: stessa.com

Download Image

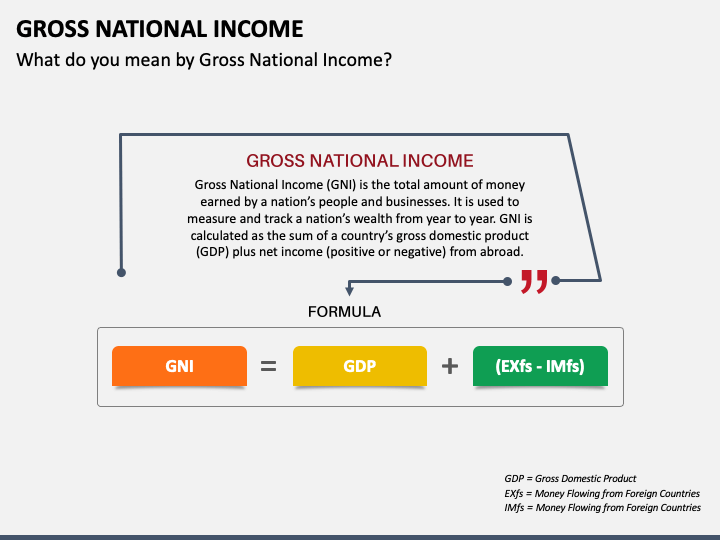

Gross National Income PowerPoint Template and Google Slides Theme Below are 10 ways to verify a potential renter’s proof of income. As a landlord, it is ideal to use a combination of these options to get a large overview of finances, but also a glimpse into the most recent income. 1. W-2 Tax Form. A W-2 tax form shows the applicant’s income from the previous tax year. W-2s are for when an employer

Source Image: sketchbubble.com

Download Image

How to calculate property value based on rental income Aug 3, 2022The best way to do that is to require proof of income when a renter applies to rent your unit. Although some ways are more commonly used than others, here are 15 ways renters can show landlords or property managers proof of income. 1. Pay Stubs. Pay stubs are one of the most used ways to show proof of income. Renters with part-time or full-time

Source Image: stessa.com

Download Image

Gross Revenue Vs Net Revenue – 7 Important Differences Explained Jan 23, 2024Proof of income is a document or set of documents that verify an individual’s stated wages or earnings. This documentation is used by landlords to determine a tenant’s ability to pay rent. By evaluating a tenant’s monthly income, job status, past payment history, and debt status, landlords can determine if the applicant is a safe choice

Source Image: hostmerchantservices.com

Download Image

Form 1065 Step-by-Step Instructions (+Free Checklist) for 2024

Gross Revenue Vs Net Revenue – 7 Important Differences Explained Mar 3, 2023However, the requirements tend to be pretty similar. You’ll usually need a reliable source of income, monthly gross income of at least three times the rent, renter’s insurance, and at least

A free rental property profit and loss statement template How to calculate property value based on rental income Below are 10 ways to verify a potential renter’s proof of income. As a landlord, it is ideal to use a combination of these options to get a large overview of finances, but also a glimpse into the most recent income. 1. W-2 Tax Form. A W-2 tax form shows the applicant’s income from the previous tax year. W-2s are for when an employer